[Note: As this article is reconstructed from a copy some

content/layout may vary from the original posting.]

Tax Farming, Talmudic Agriculture

Henry Ford once offered

in his editorial column, a $1000 reward to anyone who could

furnish him with an example of a Jewish farmer. Ford insisted

that Jews avoided

honest labour, favouring criminal activity in the financial industry.

Mr. Ford must of been

unfamiliar with Tax Farming, as

the Jews had been controlling that

form of agriculture, all around the globe, for hundreds and hundreds of

years.

Below is an explanation of Tax

Farming, followed by several examples of how Jews thrived in it.

As Israeli scholar Israel

Shahak alluded

to,

this was undoubtedly a

huge contributing factor to most of the

"pogroms," expulsions, and "blood libels" over

the centuries.

Tax Farming

Revenue farming means contracting out the

collection of state income, taxes or revenue from state-owned monopolies

and enterprises, to private bidders. It attempts to maximize revenue

through competitive bidding, in which bidders undertake to supply an

agreed-upon sum regardless of the actual yield of the revenue source. It

transfers risk and effort from the government to the tax farmer, who is

not only burdened with the labor of collection but is responsible (often

in advance) for the full sum contracted for, even if the revenue source

fails to yield it. On the other hand, if the revenue yield is higher

than the contracted amount, the tax farmer benefits from the

discrepancy, which in certain circumstances can be considerable. Tax

farming is a high-risk, high-yield investment. ... Revenue farming was

known to the ancient world and was widely employed in both east and west

down to the development of modern bureaucracy. Its use was on the rise

in early modern Europe as monarchs expanded their standing armies,

gained tighter control over their kingdoms, and sought to increase their

revenues. By contracting revenue collection to private persons,

ambitious rulers employing small numbers of officials could exploit wide

territories for their own benefit rather than delegating control to

others. In addition, granting tax farms became a means of bestowing

privilege and rewarding loyalty and service in a fashion that did not

deplete crown lands or royal treasure. Besides monetarizing and

potentially increasing the yield, tax farming also made delivery of

money to the treasury more predictable and more secure.

Darling, Linda T., Revenue-Raising and Legitimacy:

Tax Collection and Finance Administration in the Ottoman Empire,

1560-1660. E. J. Brill; Leiden, NL. 1996. p.119-121.

[full original article can be read through Google

Books if Googling the quote with

quotation marks:

"Revenue farming means contracting out the collection of state income,

taxes or revenue from state-owned monopolies and enterprises"]

Belgian Jew, Abraham Leon, real

name Wejnstok (1918 - 1944), Trotskyite, ex-Zionist, sent

to Auschwitz in June 1944, apparently he was killed there in

September 1944.

Written during WW2, Leon's book

The Jewish Question: A Marxist Interpretation was

posthumously published in 1946 in French, and then in English in

1950:

From the book (see link for

the sources, or lack of

them, he's quoted from):

The cortes of Portugal

complain of Jewish usury in 1361 as

becoming an increasingly unbearable yoke upon

the population.

(c.1650) In

total, 63 percent of the tax farming business in

Brazil was in Jewish hands."In the circles of

the Spanish nobility and rich patrician class the

Jews were hated because of their state functions,

where they showed themselves to be servile

instruments of royalty, as well as because of the

great tax and impost farming by which the Jewish

magnates unceasingly augmented their fortunes."

"In 1469 the cortes

protest against the admission of Jews to tax farming

and against the protection with which the kings

surround them. Ritual trials and massacres come

to the support of the pressures exerted by, the

nobility upon royalty."

Sometimes the Jews

also go over to the offensive. In

1376 the banker Jekl employs bands of mercenaries

against noble debtors who have refused to pay their

debts. His son engages

mercenaries with a view to launching an attack

against Nuremburg,

the council of this city having confiscated his

houses.

Leon, Abram. The Jewish Question: A Marxist Interpretation.

Originally published in French in 1946. First English edition: Ediciones

Pioneras, Mexico City 1950.

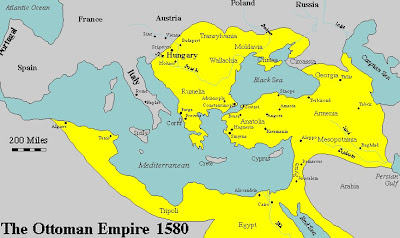

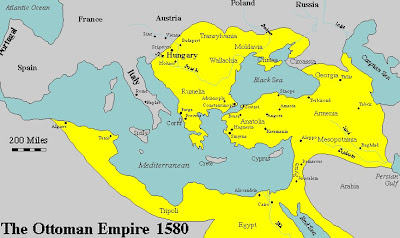

The Entire Ottoman

Empire

ooo

Having become an

important segment of Ottoman society, the

Jewish community occupied since the fifteenth

century a particularly influential position in tax

farming and in interregional and international trade.

...

Extensively applied in

the Ottoman Empire even at this early period, tax

farming was one of the most profitable economic

activities for those who had accumulated cash

capital. Short of steady and regular cash

resources to meet current needs, and lacking the

complex tax collection system of a modern state, the

Ottoman government generally depended on cash

advances from individuals who had accumulated

capital through commercial activities. The

registers of tax farming, the so-called mukata's

defterleri, from the second half of the fifteenth

century contain many names of Jewish "capitalists"

serving as tax farmers.

... We

find Jews undertaking all kinds of tax farms

everywhere in the empire, particularly in the big

cities and at important sea ports, but also in many

smaller towns in the Balkans and Anatolia. ...

Because of its crucial

importance for state finances, the tax farm of the

Istanbul customs house conferred on its holders a

great deal of influence in affairs of state. During

the fifteenth and sixteenth centuries, this position

was quite often held by Jews. ... By the second half

of the sixteenth century, Jewish bankers and tax

farmers had gained a predominant place in Ottoman

finances and long distance trade. ...

International trade,

tax farming, and banking operations were all

interconnected at this time.

Levy, Avigdor. Jews, Turks, Ottomans: A Shared History, Fifteenth

Through the Twentieth Century. Syracuse University Press. 2002.

p.8-11.

Brazil

ooo

(c.1650) In total, 63

percent of the tax farming business in Brazil was in

Jewish hands.

Jacobs, Jaap. The Colony of New Netherland: A Dutch Settlement in

Seventeenth-Century America. Cornell University Press. 2009.

p.200.

Poland, Russia, Ukraine

ooo

A source from the mid-seventeenth

century states: "Tax farming was

the cutomary occupation of most Jews in the kingdom

of Little Russia [the Ukraine] for they ruled in

every part of Little Russia." Travelers and

other observers in the seventeenth

and eighteenth centuries often

pointed out that all the innkeepers

in small urban settlements and villages were Jews.

... According to the partial 1764 census, tax

farming, leasing of estates, innkeeping, and the

sale of hard liquor in urban settlements ... in

the Polish kindom as a whole (including the Ukraine)

some 85—90 percent of the Jews were employed in

these occupations.

Weinryb, Bernard Dov. The Jews of Poland: A Social and Economic

History of the Jewish Community in Poland From 1100 to 1800. Jewish

Publication Society. 1976.

p.139.

------------------------------

"When a Jew, in America or in South Africa, talks to

his Jewish companions about 'our' government, he means the

government of Israel."

- David Ben-Gurion, Israeli Prime Minister

Viva Palestina!

Latest Additions

- in English

What is this Jewish

carnage

really about? - The background to

atrocities

Videos on Farrakhan, the Nation of Islam and Blacks and Jews

How Jewish Films and Television Promotes bias Against

Muslims

Judaism is Nobody's

Friend

Judaism is the Jews' strategy to

dominate non-Jews.

Jewish War Against

Lebanon!

Islam and Revolution

By Ahmed Rami

Hasbara -

The Jewish manual

for media deceptions

Celebrities bowing to their Jewish masters

Elie Wiesel - A Prominent False Witness

By Robert Faurisson

The Gaza atrocity 2008-2009

Iraq - war and occupation

Jewish War On

Syria!

CNN's Jewish version of "diversity"

- Lists the main Jewish agents

Hezbollah the Beautiful

Americans, where is your own Hezbollah?

Black Muslim leader Louis Farrakhan's Epic Speech in Madison Square

Garden, New York

- A must see!

- A must see!

"War on Terror" -

on Israel's behalf!

World Jewish Congress: Billionaires, Oligarchs, Global Influencers for Israel

Interview with anti-Zionist veteran Ahmed Rami of Radio Islam

- On ISIS, "Neo-Nazis", Syria, Judaism, Islam, Russia...

Britain under Jewish

occupation!

Jewish World Power

West Europe

East Europe

Americas

Asia

Middle East

Africa

U.N.

E.U.

The Internet and

Israeli-Jewish infiltration/manipulations

Books

- Important collection of titles

The Judaization of

China

Israel: Jewish Supremacy in Action

- By David Duke

The Power of Jews in France

Jew Goldstone appointed by UN to investigate War Crimes in Gaza

The best book on Jewish Power

The Israel Lobby

- From the book

Jews and Crime - The archive

Sayanim - Israel's and Mossad's Jewish helpers abroad

Listen to Louis Farrakhan's Speech

- A must hear!

The Israeli Nuclear Threat

The "Six

Million" Myth

"Jewish History"

- a bookreview

Putin and the

Jews of Russia

Israel's attack on US warship USS Liberty

- Massacre in the Mediterranean

Jewish "Religion" - What is

it?

Medias

in the hands of racists

Strauss-Kahn - IMF chief and member of Israel lobby group

Stop Jewish Apartheid!

The Jews behind Islamophobia

Israel controls U.S. Presidents

Biden, Trump, Obama, Bush, Clinton...

The Victories of Revisionism

By Professor Robert Faurisson

The Jewish hand behind Internet

The Jews behind Google, Facebook, Wikipedia,

Yahoo!, MySpace, eBay...

"Jews, who want to be decent human beings, have to renounce being Jewish"

Jewish War Against Iran

Jewish Manipulation of World Leaders

Al Jazeera English under

Jewish infiltration

Garaudy's "The Founding

Myths

of Israeli Politics"

Jewish hate against Christians

By Prof. Israel Shahak

Introduction to Revisionist

Thought

- By Ernst Zündel

Karl Marx: The Jewish Question

Reel Bad Arabs

- Revealing the racist Jewish Hollywood propaganda

"Anti-Semitism" - What is it?

Videos

- Important collection

- Important collection

The Jews Banished 47 Times in 1000 Years - Why?

Zionist

strategies

- Plotting invasions, formenting civil wars, interreligious strife,

stoking racial hatreds and race war

The International Jew

By Henry Ford

Pravda interviews Ahmed Rami

Shahak's

"Jewish History,

Jewish Religion"

The Jewish plan to destroy the Arab countries

- From the World Zionist Organization

Judaism and Zionism inseparable

Revealing photos of the Jews

Horrors of ISIS Created by Zionist Supremacy

- By David Duke

Racist Jewish Fundamentalism

The Freedom Fighters:

Hezbollah

- Lebanon

Hezbollah

- Lebanon

Nation of Islam

- U.S.A.

Nation of Islam

- U.S.A.

Jewish Influence in America

- Government, Media, Finance...

"Jews" from

Khazaria stealing the land of Palestine

The U.S. cost of supporting Israel

Turkey, Ataturk and

the Jews

The truth about the Talmud

Israel and the Ongoing Holocaust in Congo

Jews DO control the media -

a Jew brags!

- Revealing Jewish article

Abbas - The Traitor

Protocols of Zion

- The whole book!

Encyclopedia of the

Palestine Problem

The

"Holocaust" - 120 Questions and Answers

Quotes

- On Jewish Power / Zionism

Caricatures / Cartoons

Activism!

- Join the Fight!